Business Choices: Sole Proprietorship vs. Partnership firm

Introduction

When starting a new firm, choosing the correct business structure is crucial. Partnerships and Sole Proprietorships are two prominent business structures that many small business owners prefer for flexibility and simplicity. In this article, detailed information on what a Sole Proprietorship is and the difference between Sole Proprietorship and a partnership firm is discussed.

What is Sole Proprietorship?

A Sole proprietorship is a name given to a business owned and operated by a single individual. It’s the simplest type of business organization. A sole proprietorship is not considered a separate legal entity from its owner.

What are the Characteristics of a Sole Proprietor?

- Single Ownership: The term single ownership refers to the fact that the sole proprietor owns all the assets of the business, including the property. Therefore, the sole proprietor takes on all the risks associated with the business.

- Unlimited Liability: Sole proprietorship business liability is unlimited. If you lose your business, your personal assets, along with your business assets, will be used to pay your debts.

- One Man Controls: Since only one person is responsible for all the work, he has complete control. Therefore, the sole owner makes all the decisions and carries out the work in his own way.

- Less legal formalities: There are virtually no rules governing the creation, operation, and dissolution of a single-owner business.

What is a Partnership Firm?

In a partnership firm, two or more people are involved in the day-to-day management and operations of the business. The business is governed by a Partnership Deed, which outlines the terms and objectives of the partnership. Each partner contributes to the business in one way or another, such as money, assets, labor, or skills. In exchange, they share in the profits and losses of the business.

What are the characteristics of a partnership firm?

- Unlimited Liability: The members of the partnership have unlimited liability. If business assets are not sufficient to cover liabilities, creditors can claim the personal assets of all members to settle the outstanding amount.

- Partners in Profit and Loss: The primary goal of a partnership is to divide the profits in a proportionate way. If there is no agreement between the partners, the profits or losses of the business are shared among all partners.

- Number of Partners: In a partnership firm, at least two individuals are required to start the business, and the maximum number of partners is typically limited to 100.

- Mutual Understanding: The partnership business is carried out by all partners or by any partner acting on behalf of all partners. Therefore, each partner is both a principal and an agent.

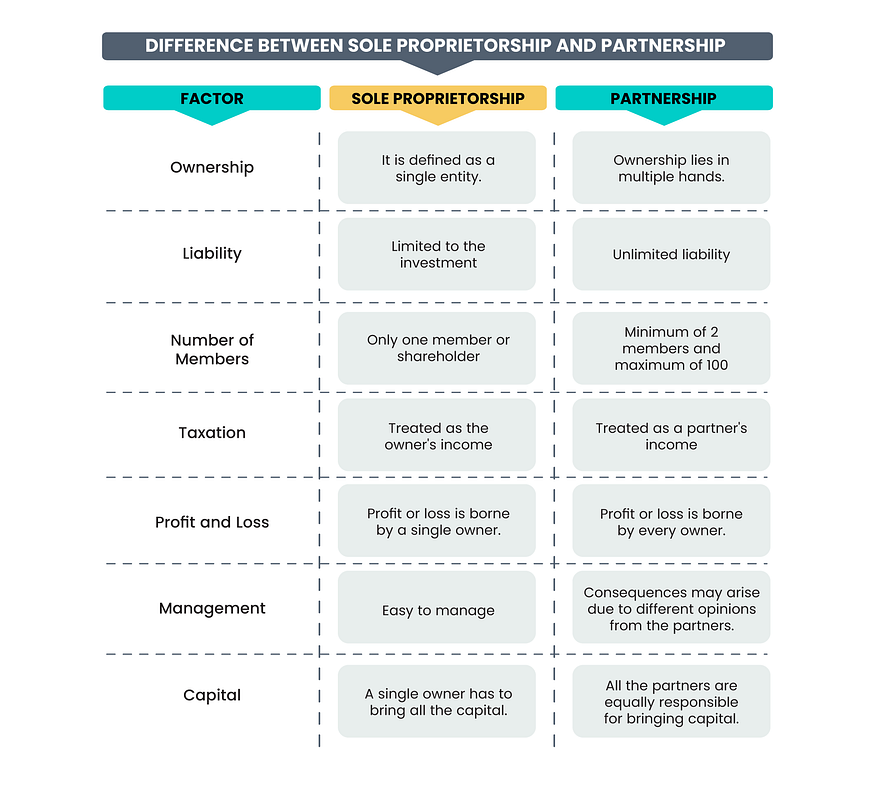

Difference between Sole Proprietorship and Partnership

Embark on your entrepreneurial journey with our comprehensive services. Opt for our hassle-free “Partnership Firm Registration” if you’re looking to collaborate and share profits in a joint business venture. If you prefer complete control over your business, our streamlined “Sole Proprietorship Registration” process is the perfect fit for you. Make your business dreams come true with us.

Conclusion

Many factors that go into the decision-making process when it comes to choosing a partnership or sole proprietorship structure. These include the number of people involved, the degree of control you’d like to have over your business, and the extent to which you’re willing to share responsibility and liabilities. Each of these structures has its pros and cons, and the decision often comes down to what’s best for your business.

Comments

Post a Comment